A Guide to Monthly Tax Obligations for Businesses in Cambodia (2025)

A Guide to Monthly Tax Obligations for Businesses in Cambodia (2025)

Navigating the monthly tax landscape is a fundamental responsibility for every business operating in Cambodia. With the General Department of Taxation (GDT) continuously evolving its processes, staying compliant can feel overwhelming. This guide provides a clear overview of your key monthly tax obligations for 2025, helping you understand what needs to be filed and when.

Failure to meet these obligations can result in significant penalties, making timely and accurate filing not just a legal requirement, but a critical financial practice.

What Are the Core Monthly Tax Filings?

For most businesses registered with the GDT, there are two primary monthly tax declarations:

1. Monthly Tax on Income (Prepaid Tax or TOI)

This is an advance payment of your annual Income Tax, calculated based on your previous year’s turnover or your current monthly revenue.

- Who files? All taxpayers classified as Medium and Large enterprises.

- Calculation: The rate is 1% of your monthly turnover, unless you have an official confirmation from the GDT stating otherwise.

- Important Note: This prepaid tax is credited against your annual Income Tax liability when you file your annual tax return.

2. Value Added Tax (VAT) Declaration

VAT is a consumption tax levied on the supply of goods and services. Businesses act as collectors for the government.

- Who files? All businesses with an annual taxable turnover exceeding 250 million KHR (approx. $62,500) must register for VAT and file monthly returns.

- Calculation: The standard rate is 10%. You declare Output VAT (VAT on your sales) and deduct Input VAT (VAT on your eligible business expenses). The difference is paid to the GDT.

- VAT Filing: Even if your output and input VAT cancel each other out (resulting in a zero payment), a nil declaration must still be submitted.

Understanding Your Taxpayer Classification

Your filing requirements depend on how the GDT classifies your business:

- Small Taxpayer (ST): Generally exempt from monthly TOI prepayments. Focuses on VAT obligations if applicable.

- Medium Taxpayer (MT): Must file and pay both Monthly TOI (1%) and VAT.

- Large Taxpayer (LT): Must file and pay both Monthly TOI and VAT, often under closer scrutiny and with stricter deadlines.

Key Monthly Deadlines to Remember

The absolute deadline for submitting both your Monthly TOI and VAT declarations is the 20th day of the following month.

- Example: Your tax obligations for January 2025 must be declared and paid by February 20, 2025.

Missing this deadline triggers automatic penalties from the GDT, including fines and accrued interest on any owed amounts.

How to File Your Monthly Taxes

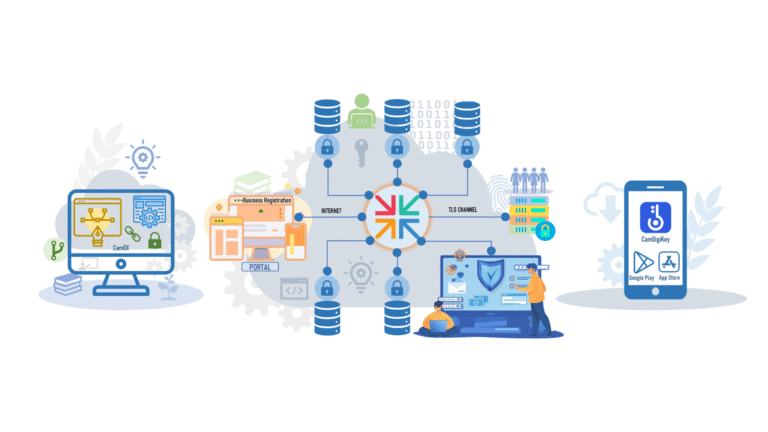

Filing is done electronically through the GDT’s online e-filing portal. This requires a registered account and a valid digital certificate.

A Simple Checklist for Your Monthly Compliance

✓ Calculate gross turnover for the month.

✓ Calculate 1% Monthly Prepaid Tax (TOI) on turnover.

✓ Calculate total Output VAT from taxable sales.

✓ Calculate total eligible Input VAT from business purchases.

✓ Prepare supporting documents and invoices.

✓ Log in to the GDT e-filing portal before the 20th.

✓ Submit both declarations and make the necessary payments.

Conclusion: Simplify Your Monthly Filing

Managing monthly tax obligations requires consistent attention to detail and an understanding of Cambodia’s regulations. While this guide outlines the basics, the nuances of your specific business—deductible expenses, VAT exemptions, and correct classification—can add layers of complexity.

Let BDB Advisory Handle Your Compliance

Why spend valuable time navigating portals and worrying about deadlines? Our team of expert tax advisors ensures your monthly filings are 100% accurate and submitted on time, every time. We protect you from penalties and give you peace of mind.

Contact us today for a consultation. Focus on growing your business, and leave the tax complexity to us.