Your 2025 Guide to Registering a Business in Cambodia via CamDX

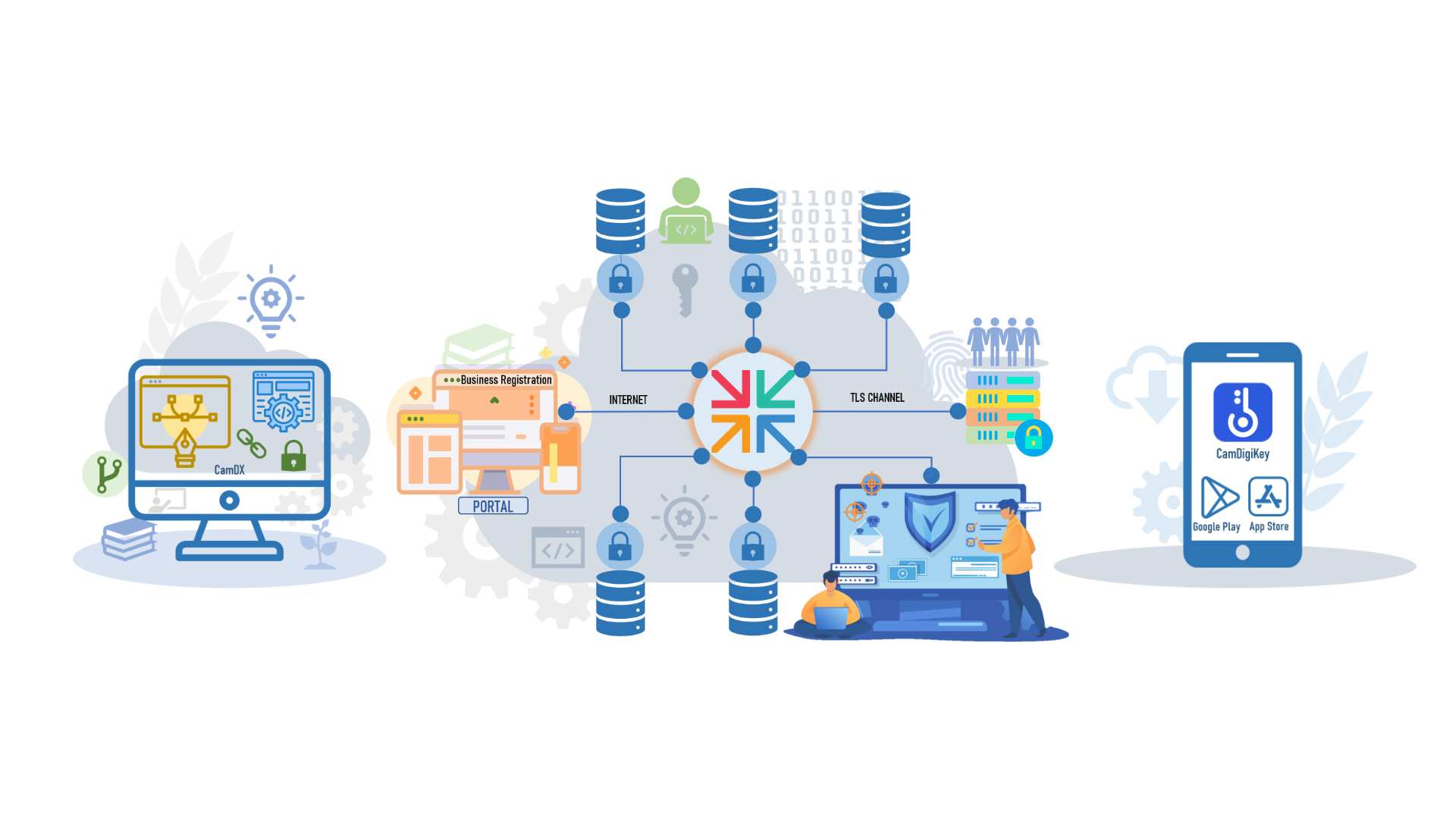

Cambodia’s economy is booming, and the government has made significant strides in simplifying the business startup process. The cornerstone of this effort is the CamDX (Cambodia Data Exchange) platform, a one-stop online portal designed to streamline company registration with the Ministry of Commerce (MOC).

While CamDX has made the process more accessible, navigating it correctly requires a clear understanding of Cambodian regulations. A single misstep can lead to application rejections, delays, or unforeseen tax complications. This guide will walk you through the key stages of online registration and highlight where expert guidance can ensure your business starts on a solid, compliant foundation.

Why Register via CamDX?

CamDX integrates various government agencies, allowing entrepreneurs to submit their registration documents to the MOC electronically. This reduces paperwork and processing times—in theory. However, the system requires precise information, and the requirements differ depending on your business structure (e.g., sole proprietorship, private limited company).

The Key Steps to Register Your Business Online

Here is a high-level overview of the process:

1. Preparation is Everything

Before you even log in to CamDX, you must prepare. This is the most critical phase and where many applications stall. You will need:

- A proposed company name (with backups).

- A clear definition of your business activities (aligned with the Cambodian Standard Industrial Classification code).

- Detailed information on shareholders, directors, and their nationalities.

- A drafted Memorandum and Articles of Association (MOA/AOA). The wording in these documents is crucial, as it can impact your future tax obligations and legal flexibility.

2. Reserve Your Company Name

Through the CamDX portal, you will submit your proposed company name for approval. The MOC will check for uniqueness and compliance. Having a expert review your name choices can prevent unnecessary rejections.

3. Submit the Full Application Package

Once your name is approved, you will submit your complete application. This includes the MOA/AOA, identification documents for all involved parties, and forms detailing your registered address and capital. The MOC will review everything. Any inconsistency or missing information will result in a request for clarification or outright rejection.

4. Receive Your Registration Certificates

Upon approval, you can download your official Certificate of Incorporation and Patent Tax Certificate from the portal. Congratulations, your legal entity now exists!

The Most Common Pitfalls to Avoid

This is where the “simple” process gets complex. Many new businesses encounter these hurdles:

- Vague Business Objectives: Defining your business activities too broadly can lead to a higher patent tax bracket and future issues with licensing.

- Incorrect Capital Structuring: The structure of your share capital and contributions can have significant long-term tax implications.

- The Post-Registration Maze: Your MOC registration is just step one. Within specific deadlines, you must also register with the General Department of Taxation (GDT), obtain official invoices, and understand your ongoing monthly and annual filing obligations. Many new companies inadvertently incur penalties because they are unaware of these critical next steps.

You’re Registered. What’s Next?

Many companies make the mistake of thinking the hard work is over after receiving their certificates. In reality, it has just begun. Your immediate next steps include:

- Registering with the GDT for tax purposes.

- Understanding your monthly tax obligations (Prepaid Tax, VAT, etc.).

- Setting up a compliant accounting system.

- Registering employees with the National Social Security Fund (NSSF).

Navigating this post-registration compliance landscape is often more challenging than the initial incorporation.

Start Your Business Journey on the Right Foot

While CamDX empowers you to start the process yourself, the complexities of Cambodian business law, tax classification, and ongoing compliance are best handled by experts.

At Barak DB Advisory, we do more than just fill out forms. We provide strategic guidance from the very beginning. We ensure your business is structured correctly from day one to optimize tax efficiency, avoid penalties, and support sustainable growth.

Our Business Registration & Licensing service handles the entire process for you, ensuring precision at every stage and providing you with a clear roadmap for your post-registration compliance requirements.

Don’t let paperwork and complexity slow down your vision. Focus on your business strategy, and leave the regulatory compliance to us.

Contact us today for a confidential consultation to discuss your business goals and how we can ensure your launch in Cambodia is a seamless success.